Note: This extension is for state taxes.

MONTGOMERY – The Alabama Department of Revenue (ADOR) is extending deadlines to file tax returns for individuals and businesses who were affected by severe weather on March 19.

“Our thoughts and prayers are with the people of Alabama who have been affected by these disastrous storms,” said Revenue Commissioner Vernon Barnett. “As they recover from the challenges and hardships caused by the storms, the Department is offering this assistance to hopefully help ease some of the burden.”

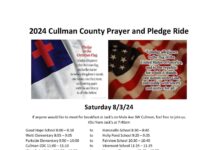

Those taxpayers affected by the storms in the declared emergency areas with returns due from March 20 through April 30 have two months beyond the original deadlines to file without penalties. The counties included in the state of emergency declaration are: Blount, Calhoun, Cherokee, Clay, Cleburne, Colbert, Cullman, DeKalb, Etowah, Fayette, Franklin, Jackson, Jefferson, Lamar, Lauderdale, Lawrence, Limestone, Madison, Marion, Marshall, Morgan, Randolph, Shelby, St. Clair, Talladega, Walker and Winston.

Taxpayers seeking this relief should write “Severe Weather Relief – 2018” in red ink on any state paper return/report which relies on this filing extension relief. In regard to electronically-filed returns/reports, affected taxpayers should contact ADOR for filing guidance. Taxpayers may contact the following ADOR offices by telephone:

- Individual Income Tax: 334-353-0602

- Corporate Income Tax: 334-242-1200

- Pass-through Entities: 334-242-1033

- Sales and Use Tax: 334-242-1490

- Business Privilege Tax: 334-353-7923

- Withholding Tax: 334-242-1300

- Business and License Tax: 334-242-9600

- Motor Vehicle: 334-242-9000

In addition, taxpayers in areas not specifically designated in the state of emergency declaration who encounter difficulty filing on time due to weather-related circumstances associated with the March 19 storms may be eligible to request a waiver of late-filing and late-payment penalties after providing appropriate documentation to ADOR.