CULLMAN, Ala. – The Cullman County Mayors and Commissioners Association met Wednesday, Dec. 17, at Terri Pines to review how sales, use and lodging tax revenue is collected and distributed among municipalities, school systems and county services.

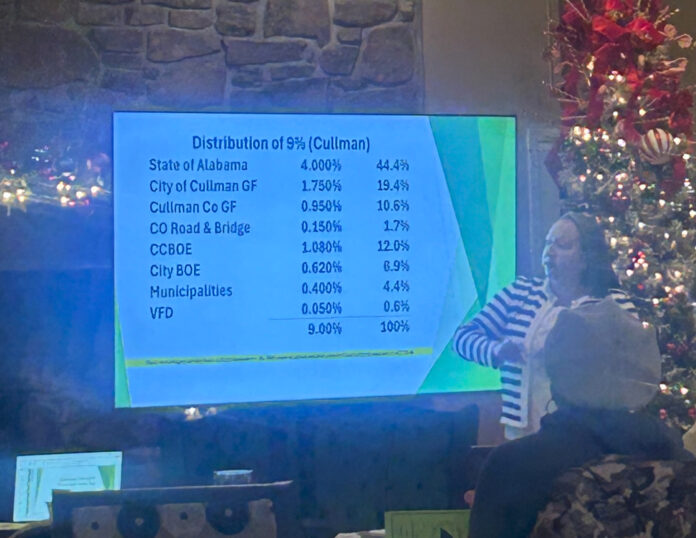

Officials explained that multiple state laws govern tax distribution, with funds allocated to cities, the county, school systems, fire departments and the county hospital board. Monthly distributions vary based on collections and population.

The discussion included the Simplified Sellers Use Tax, which applies to many online purchases shipped into Alabama. Officials said the program allows counties and municipalities to collect revenue from out-of-state retailers that previously paid little or no local tax. While the rate is lower than traditional local sales taxes, officials said it increases compliance and captures revenue that would otherwise go uncollected.

Concerns were raised about fairness to brick-and-mortar businesses, which pay full sales and property taxes, compared with online retailers operating outside county boundaries. Officials said state law and court rulings limit changes to the simplified tax structure.

Revenue officials reported that more than $72 million was collected and distributed during the 2023–2024 fiscal year, with about $89.5 million collected so far in the 2024–2025 fiscal year.