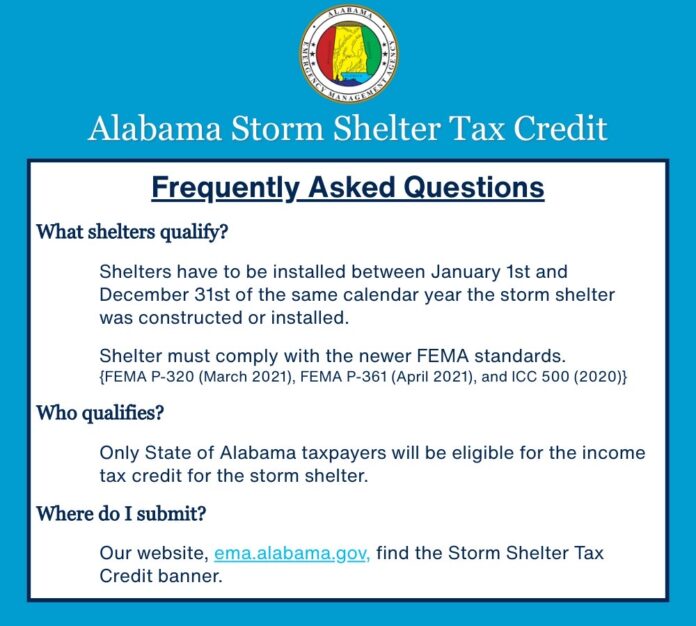

CULLMAN, Ala. – Alabama homeowners may be eligible for a state income tax credit to help offset the cost of building or installing a storm shelter at their primary residence.

The Storm Shelter Tax Credit is administered jointly by the Alabama Emergency Management Agency (AEMA) and the Alabama Department of Revenue (ADOR). The program allows a credit of up to $3,000 or 50 percent of the total cost of the shelter, whichever is less.

The credit was established through Act 2021-540. To qualify, the storm shelter must be constructed, acquired or installed during the same calendar year the credit is claimed, and it must serve as the taxpayer’s primary residence.

According to AEMA, eligible shelters must meet design criteria established by the Federal Emergency Management Agency, including FEMA P-320 (March 2021), FEMA P-361 (April 2021), and ICC 500 (2020). The statewide cap for all approved credits is $2 million per year, and credits are issued on a first-come, first-served basis.

To apply, homeowners must submit a certification request through the AEMA portal at www.ema.alabama.gov. Once approved, AEMA issues a certificate that allows the taxpayer to claim the credit through ADOR’s My Alabama Taxes portal using Schedule OC when filing their annual state income tax return.

Installation costs covered by other programs, grants or insurance reimbursements are not eligible for the credit.

For additional information or to begin an application, visit www.ema.alabama.gov or contact AEMA at 205-280-2200.